The skyrocketing growth of unconventional oil and natural gas production in the United States has ignited an intense debate on the impact of energy exports on U.S. energy and economic security and its foreign policy. In “Changing Markets: Economic Opportunities from Lifting the U.S. Ban on Crude Oil Exports,” Charles Ebinger and Heather Greenley worked with National Economic Research Associates (NERA) to examine the economic and national security impacts of lifting the ban on crude oil exports. Learn eight facts about U.S. crude oil production within the key findings outlined below, and download the full report.

U.S. Economic Benefits

Key Finding: Lifting the ban on crude oil exports from the United States will boost U.S. economic growth, wages, employment, trade and overall welfare. For example, present discounted value of gross domestic product (GDP) in the high oil and gas resource (HOGR) case through 2039 is between $600 billion and $1.8 trillion, depending on how soon and how completely the ban is lifted.

Fact 1. In all three cases — delaying lifting the ban until 2015, lifting the ban only on condensates or lifting the ban entirely — there are positive percentage change impacts on GDP throughout the model horizon.

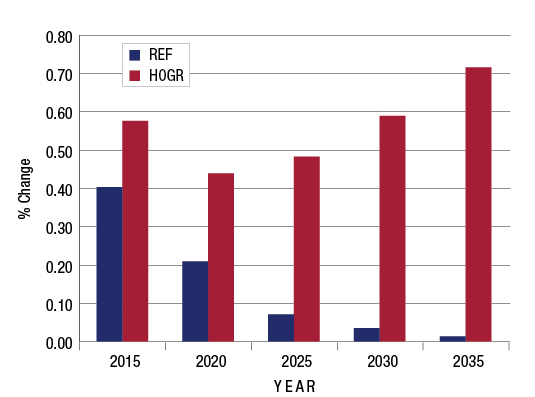

In regards to the impact on GDP, NERA found in the reference case that lifting the ban entirely by 2015 will result in an increased percentage change of 0.40 percent in 2015 (see figure below). While this percentage change may seem miniscule on the surface, there are very few actions that the U.S. government can take that as a long-term instrument of economic policy would make as measurable a difference in the economy. According to NERA, in all three cases — delaying lifting the ban until 2015, lifting the ban only on condensates or lifting the ban entirely — there are positive percentage change impacts on GDP. Throughout the model horizon (2015 – 2035) in the reference case, the size of these benefits drop as oil production declines. In the high case, an initial spike in GDP occurs after the ban is lifted and continues all the way to 2035 tracking closely, the high case increase in domestic production (see figure below). In short, increases in GDP move in conjunction with rising exports. Throughout 2015 – 2039, NERA finds that the discounted net present value of GDP in the reference case could be greater than $550 billion, while in the HOGR case it could exceed $1.8 trillion. GDP percentage increases are greatest at the front end of lifting the ban and are in line with light tight oil (LTO) production as it drops. In the HOGR case, an increase in the percentage change in GDP is maintained through 2035, as it tracks closely with the continued increase in exports.

Figure: Percentage Change in GDP When Ban is Lifted Immediately

Fact 2. In the reference case lifting the ban entirely in 2015 will result in a 0.14 percent change in welfare compared to 0.05 percent if lifting the ban were delayed to 2020.

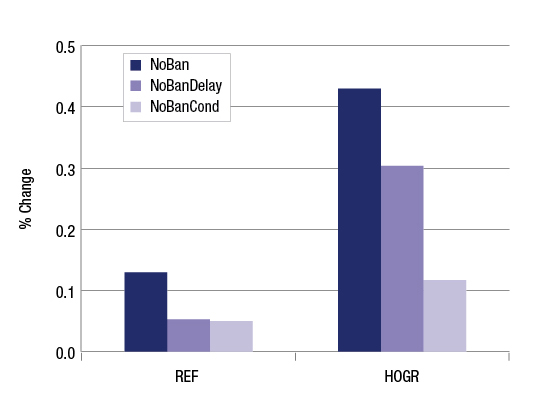

In addition to GDP, NERA examined the impact on U.S. welfare. NERA found that lifting the ban completely will have just over a 0.40 percent change in welfare in the HOGR case over the model horizon (2015 – 2035); however, there is an overall net benefit to welfare inciting a positive change in the U.S. economy across all scenarios. In the reference case (see figure below) lifting the ban entirely in 2015 will ignite approximately a 0.14 percent change in welfare while waiting until 2020 will generate only a 0.05 percent change — half of the 2015 lifting scenario, which is similar to lifting the ban only for condensate. A critical NERA finding in the HOGR scenario (see figure below) is the higher production of crude oil leads to higher welfare benefits across all scenarios.

Figure: Percentage Change in Welfare in NoBan, NoBanDelay, and NoBandCond in Reference and HOGR Cases

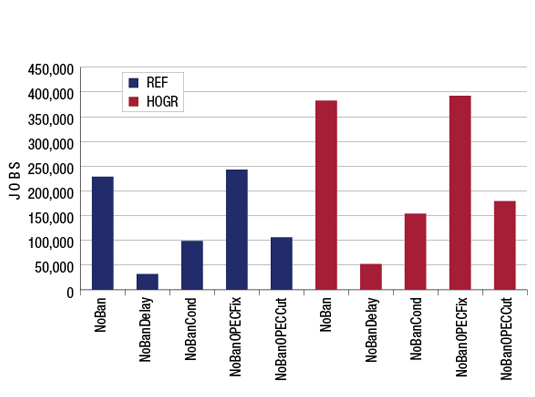

Fact 3. Lifting the ban by 2015 reduces unemployment at an average annual reduction of 200,000 from 2015 – 2020 according to the reference case.

Finally, lifting the ban entirely by 2015, reduces unemployment at an average annual reduction of 200,000 from 2015 – 2020 (see figure below) in the reference case. Employment impacts are economy wide rather than solely oil industry specific or necessarily new jobs. Rather, as the welfare benefits from lifting the ban ripple through the economy, there will be a host of people flocking to new employment opportunities. Delays in lifting the ban or partial relief (such as condensate alone) reduce employment benefits significantly. A partial lifting of the ban for condensates decreases the employment gains by nearly half in the reference case. Furthermore, in the reference case, delaying action until 2020 decreases unemployment to less than 50,000 on average from 2015-2020. In sharp contrast, in the HOGR case, unemployment on an annual average falls by nearly 400,000 from 2015 – 2020 if the ban is lifted entirely in 2015 (see figure below).

Figure: Average Annual Reduction in Unemployment Across All Scenarios and Both Cases (2015 – 2020)

U.S. Crude Oil Production

Key Finding: Benefits are greatest if the U.S. lifts the ban in 2015 for all types of crude. Delaying or allowing only condensate exports lowers benefits by 60 percent relative to a complete and immediate removal of the ban. If oil and gas supplies are more abundant than expected, allowing only condensate exports lowers the benefits by 75 percent relative to completely lifting the ban. The chief reason for this is that the greatest increase in light tight oil (LTO) production comes in 2015. Therefore a delay would forego significant benefits. In addition, according to the U.S. Energy Information Administration (EIA) data, the volume of condensate is smaller than LTO and it is discounted less comparatively so exempting it entirely adds fewer benefits than removing the ban on all crude oil.

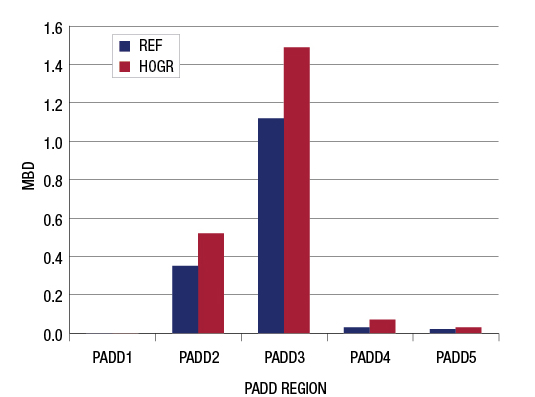

Fact 4. Petroleum Administration for Defense District (PADD) 3, otherwise known as the Gulf Coast, could in the HOGR case produce an additional 1.5 million barrels per day (mbd) in 2015 if the ban was lifted.

Our analysis shows that exposing U.S. producers to international prices increases U.S. production, sustains lower gasoline prices and reduces unemployment. In both the reference and HOGR scenario, lifting the ban entirely by 2015 increases production. In the reference case that increment declines over time, while in the HOGR case it continues to grow to 4.3 mbd in 2035.

A significantly high portion of this growth, roughly 1.1 mbd in the reference case and 1.5 mbd in the high case will occur in PADD 3 (Gulf Coast) in 2015. PADD 2 (Midwest) is the second highest producing area at nearly 0.38 mbd in the reference case and 0.5 mbd in the high case (see figure below).

Figure: Distribution of Incremental Production by PADD in 2015

Gasoline Prices

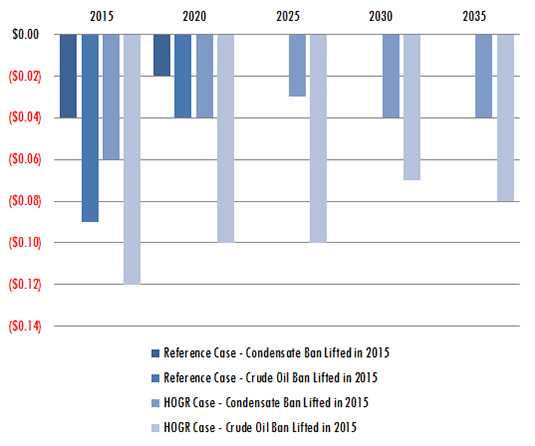

Key Finding: Lifting the ban actually lowers gasoline prices by increasing the total amount of crude supply. In the reference case, the decrease in gasoline price is estimated to be $0.09 per gallon in 2015. If oil supplies are more abundant than currently expected, the decline in gasoline prices will be larger ($0.07 to $0.12 per gallon) and will continue throughout the model horizon (2015 – 2035).

Fact 5. U.S. gas prices could decline by $0.09 per gallon in 2015 if the ban is lifted entirely.

A major public (and political) concern is whether allowing crude oil exports will raise prices for gasoline and other petroleum products. As counterintuitive as it may seem, lifting the ban actually lowers gasoline prices by increasing the total amount of crude supply, albeit by only a modest amount. NERA shows that in the reference case, 2015 gasoline prices decline by $0.09 per gallon if the ban on crude oil is lifted entirely in 2015, while we see no impact on gasoline prices from 2025 through the model horizon of 2035 (see figure below). In the HOGR case, prices decrease $0.12 per gallon in 2015 and $0.10 per gallon in 2025 if the ban is lifted by 2015. Lifting the ban on condensates by 2015 reduces gasoline prices by $0.04 per gallon in the reference case and $0.06 per gallon in the high case in 2015.

Gasoline prices decline when the ban is lifted because they are set in the international market. The international price of crude declines as more U.S. oil enters the market, driving down gasoline prices. The lowering in gasoline prices indicated in the figure below is based on a national average of gasoline prices, and may not actually reflect the changes on a regional or state level, where state gasoline taxes also will vary. Regardless of location, however, the data indicates that gasoline prices will fall across the board.

Figure: Decrease in Gasoline Prices in U.S. ($/Gallon)

OPEC Reaction

Key Finding: It is unlikely that U.S. oil exports will be a major calculus in the Organization of the Petroleum Exporting Countries' (OPEC) behavior.

Fact 6. In the HOGR case, the U.S. would be able to increase exports by 2.8 mbd in 2015 and 5.7 mbd in 2035 if OPEC decides to maintain the price of oil and cut crude exports.

OPEC is no longer, if it ever were, a monolithic institution. Saudi Arabia is the leader of OPEC by virtue of being its largest producer and the largest holder of spare production capacity in the world today. Saudi Arabia has proven multiple times its ability, and frequently its willingness, to mitigate the impacts of market disruptions by releasing spare capacity. So far, Saudi Arabian leaders have publicly downplayed their concerns over the prospects for tight oil production in the U.S. To the extent that global demand for oil is strong, or disruptions persist, there is room for OPEC members to maximize production and for U.S. supply to gain share without impairing OPEC revenues.

If demand were to weaken, however, or if Iran, Iraq, Libya, Nigeria or others were to restore disrupted production, Saudi Arabia and other OPEC members will be forced to choose whether to accept a smaller share of global oil exports to make room for U.S. and other supplies or to keep their market share at its current level by maintaining production driving down prices. In this scenario, U.S. exports would rank far lower on OPEC's agenda than a potentially resurgent Iraq or Iran.

Complicating the ability to project how Saudi Arabia and OPEC may react are the uncertainties facing OPEC production internally. Since the 1980s, Saudi Arabia has been the undisputed principal oil exporter within OPEC. Given instability and production problems in other OPEC nations, including Nigeria, Libya, Iraq and Angola, there have been fewer major OPEC producers to take into consideration when setting production targets. Looking forward, however, expectations are that production in Iran and/or Iraq could see a major upswing, meaning that internal decisions will have to be made about how best to allocate quotas and production targets. Iran or Iraq (or both) will seek larger production quotas within OPEC's broader production cap. OPEC countries are highly dependent on oil revenues. Their reluctance to reduce their individual production quotas to make room for others and forsake national export revenues has increased in recent years. This is because many states increasingly value these revenues as a means to alleviate public angst in the midst of major unrest in the Arab world. It is certain that OPEC faces a future of internal divisions and disparate goals, and it is unclear whether the organization will continue to function and impact the market as effectively as it has in the past. However, given the relatively small volumes of exports projected, at least in the reference case, it is unlikely that U.S. oil exports will be a major calculus in OPEC's behavior.

According to NERA's data, if OPEC competes for market share with the lifting of the ban on U.S. crude oil exports and maintains crude export levels, it will have a negligible effect on U.S. crude oil exports (see figure below of the reference and HOGR cases). If, however, OPEC decides to maintain the price of oil and cut crude exports, the U.S. will be able to increase exports in the HOGR case by 2.8 mbd in 2015 and by 5.7 mbd in 2035.

Figure: Crude Oil Exports from U.S. (MBD)

U.S. Foreign Policy and Energy Security

Key Finding: Permitting the export of crude oil will enhance U.S. global power in several ways, including: reinforcing the credibility of U.S. free and open market advocacy; allowing for the establishment of secure supply relationships between American producers and foreign consumers; increasing flexibility to export crude to others to address supply disruptions; empowering another non-OPEC nation to meet the growing energy demands from countries in Asia, as well as other rapidly developing nations; shifting oil rents to the U.S. from less reliable suppliers; and providing our own hemisphere with a competitive source of crude supply. Most importantly, allowing crude oil exports will increase revenues to domestic producers helping to maximize the scope of the production boom, boosting American economic power that undergirds U.S. national power and global influence.

Fact 7. Removing oil export constraints will enhance U.S. energy security.

Allowing the free export of oil will enhance U.S. energy security in five ways:

- Allowing the U.S. producers to connect to global price signals will sustain U.S. oil production, securing self-sufficiency in light grades of oil.

- By encouraging the production of light grades of oil, even as they remain surplus to U.S. refining needs, the U.S. increases global oil supply, directionally lowering U.S. product prices, which are priced to global benchmarks of crude oil.

- The U.S. reduces the volatility of global crude oil prices by allowing U.S. supply to react to changes in global oil demand.

- The U.S. can create a major source of diversification to the global oil supply. Indeed, the rapid growth of U.S. production has already diversified global supply, impacting global markets by displacement. As noted earlier in the report, the U.S. is already reaching the limits to which it can displace light oil imports. The U.S. will only connect to the global oil market if it allows exports of surplus grades of oil to flow to those countries that need those grades.

- By allowing exports of U.S. crude oil the U.S. will create a more competitive oil market. For decades, incremental oil demand has been met first by non-OPEC countries that (except for the United States) export all of their production not consumed domestically. The balance is met by OPEC, based on its desired price level. This level is implemented by production quotas and actual production levels. To the extent that incremental oil demand is met by non-OPEC production, OPEC must either cut its own production to maintain price levels, or cede market share to non-OPEC countries.

Fact 8. The U.S. will be judged by the example it sets as a market actor.

The policy decisions that face the nation will reflect broadly on what the U.S. stands for and what example it sets as it interacts with allies and adversaries over energy. Over the past few years, numerous energy analysts have cautioned policymakers and attempted to educate the public about the consequences of choosing isolationist foreign policies because of the misperception that the U.S. will be “energy independent.” U.S. leaders repeatedly say that while growing oil production in the U.S. – and North America more broadly – benefits the economy, lowers the need for imported oil and allows America a greater opportunity to determine its own energy future, this abundance of oil will not sever ties to global oil markets, or eliminate vulnerability to global price fluctuations.

The reality is that nations will judge the United States by its actions. The country faces a choice as to whether or not it will take steps to sustain and expand its contribution to global energy security at a time when insecurity is rampant in nearly every other region of the world. Economic analysis shows that the U.S. will need to remove long standing export restraints to sustain this boom. Diplomatic analysis suggests that the U.S. will be judged by its willingness to share its surpluses with others and practice the tenets of free trade and open markets that the U.S. has preached since the end of the World War II.

The American refusal to do so will be seen as yet another form of isolationism, which will leave the U.S. more vulnerable to the fluctuations of the global oil market and less capable of rapid response to alleviate those impacts. Isolationism will severely limit the U.S. capability to help allies achieve greater energy security. The U.S. policy on petroleum exports and decisions about the ban are only one of the foreign policy tools at the nation's disposal, but it can be a very important tool. U.S. exports of crude oil, in addition to the petroleum products and coal already being exported and the liquefied natural gas (LNG) in the pipeline, will represent a significant U.S. commitment to global supply security and market stability. In addition to other foreign policies regarding energy security, including efforts to ensure supply diversity through infrastructure development abroad, the promotion of market reform and indigenous resource production, research and development focused on alternative fuels and energy efficiency, the U.S. commitment to global energy security will be enhanced. The foreign policy impacts of crude oil exports are weighty, and should not be overlooked in this policy debate.

In summation, increasing crude oil exports in any fashion will have positive economic effects both in the United States and in the world oil market. At the same time, world energy security will be enhanced by increasing the diversification of oil supply available globally, while also increasing U.S. energy security. Lifting the ban generates paramount foreign policy benefits, increases U.S. GDP and welfare and reduces unemployment. It is time the United States commits to its position on free trade markets as a true member of the Organization for Economic Cooperation and Development and global community and allows U.S. crude oil to flow.